It's all too common, but unfortunately the way some lawyers handle their clients' estate plans create more problems than solutions for future generations.

It's critical that you understand exactly what will happen after you become incapacitated or when you die, to ensure that the people you love don't end up cleaning up an estate planning nightmare while also grieving your passing.

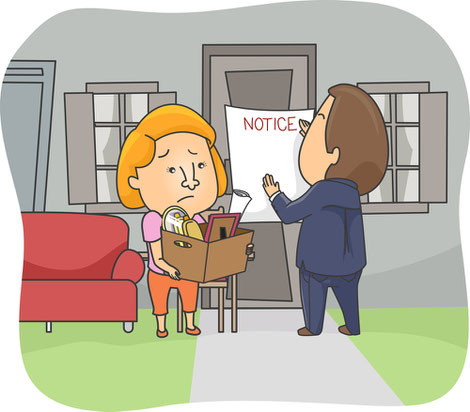

Recently in Columbus, Ohio, a mom of four kids is not only grieving the death of her mother, but now also facing eviction from her home.

Here's how it happened: Grandma signed a will in mid-2015 putting all of her assets in trust for the education of her six grandchildren. She indicated that her local bank should manage those assets for the benefit of the education of those grandchildren. That seems like a great thing to do, right?

Right. Except that then in 2016, Grandma then bought a home for one of her daughters and her daughter's four children. And she didn't update her will.

Unfortunately, this oversight is far too common due to the way many lawyers serve their clients. Their estate plans are often just focused on the documents

If you have a business, make sure you've fully separated personal and business assets. And that you are using your business entity properly, to ensure that any business activities are kept within your business entity, and that you have us review any personal guarantees before you sign something that could create personal liability for you.

If you need more thorough asset protection, due to an upcoming marriage, or engaging in other risky behavior, please contact us sooner rather than later.

Asset protection cannot happen after something happens. It must be set up ahead of time to be effective, and so it must happen now if you want to get set up right.

Protecting your assets takes know-how. If you're ready to develop a smart asset protection plan, consider sitting dow with a Family Business Lawyer™. As your Family Business Lawyer™, we can help you with your asset protection planning needs. Our Family Wealth Planning Session guides you to protect and preserve what matters most. Before the session, we'll send you a Family Wealth Inventory & Assessment to complete that will get you thinking about what you own, what's most important to you, and what you can do to ensure your family is taken care of.

This article is a service of Sky Unlimited Legal Advisory, Family Business Lawyer™. We don't just draft documents, we ensure you make informed and empowered decisions about life and death, for yourself and the people you love. That's why we offer a Family Wealth Planning Session™, during which you will get more financially organized than you've ever been before, and make all the best choices for the people you love. You can begin by calling our office at (650) 761-0992 today or book online to schedule a Family Wealth Planning Session.