Estate Planning · September 16, 2022

Know that no matter how poor or rich your parents are, they must have an estate plan in place because their affairs will affect you and become your responsibility if they become incapacitated or die. Their estate plan ensures that their assets will be distributed to their heirs according to their personal wishes, no matter how much or how little they can be. If you do not know whether or not your parents have an estate plan in place that will help you best support them, read on!

Estate Planning · February 04, 2022

Life insurance is a key component of your family’s estate plan, offering those who depend on you for their financial security a safety net in the event of your death. Whether those dependents include your spouse, children, aging parents, business associates, or all of the above, investing in life insurance is a way to say “I love you” and make certain that when you pass away, the people you love will have a reliable source of financial support to count on.

Estate Planning · August 14, 2020

Most people believe that having an estate plan simply means drafting a will or a trust. Both wills and trusts are estate planning documents that can be used to pass your wealth and property, however, there is much more to include in your estate plan to make certain your family members access or control your assets should you become unable to do so yourself, and that all of your assets are transferred seamlessly to your heirs upon your death. Here are a few reasons to consider adding a trust to y

Estate Planning · July 03, 2020

The last will and testament laws vary from state to state and so, the validity of your will depends on where you live when you die. Your will is a part of your legal documents, a baseline foundation of your estate plan that can ensure your wishes are respected by the people you love when you die. However, it may not be enough to protect your wishes as it does not keep your assets out of court and does not operate in the event of your incapacity. Moreover, it is useless if it is not legally valid

Estate Planning · April 24, 2020

Keeping your loved ones out of the probate court and conflict is the primary reason for establishing a living trust. It plays a major part in you and your loved one's life because it does not only keep them out of court and conflict, but it also helps educate them on your true purpose and details what your wishes are for your assets upon your demise. Read here to know if your living trust is set up the right way for the people you love.

Estate Planning · April 03, 2020

Your retirement account assets are extremely valuable, and you’ll want to ensure those assets are well managed not just for yourself but for your future generations. While the SECURE Act has significantly altered the tax implications for retirement planning and estate planning, there are still plenty of tax-saving options available for managing your retirement account assets, but these options are only available if you plan for them. Read here to know more.

Estate Planning · March 27, 2020

The changes ushered in by the SECURE Act have dramatic implications for both your retirement and estate planning strategies—and not all of them are positive. Here are three of the SECURE Act’s biggest changes and how they stand to affect your retirement account both during your lifetime and after your death.

Estate Planning · February 28, 2020

We are always at risk of becoming incapacitated or deceased — even when there is not the coronavirus seemingly taking over the world by infecting and killing thousands of people. While now is a good time to ensure your estate planning documents in place and up-to-date, I should note that it is always a good time to make sure this important task is completed to ensure that your wishes are honored in the event of your incapacity and that your kids and loved ones are protected.

Estate Planning · February 07, 2020

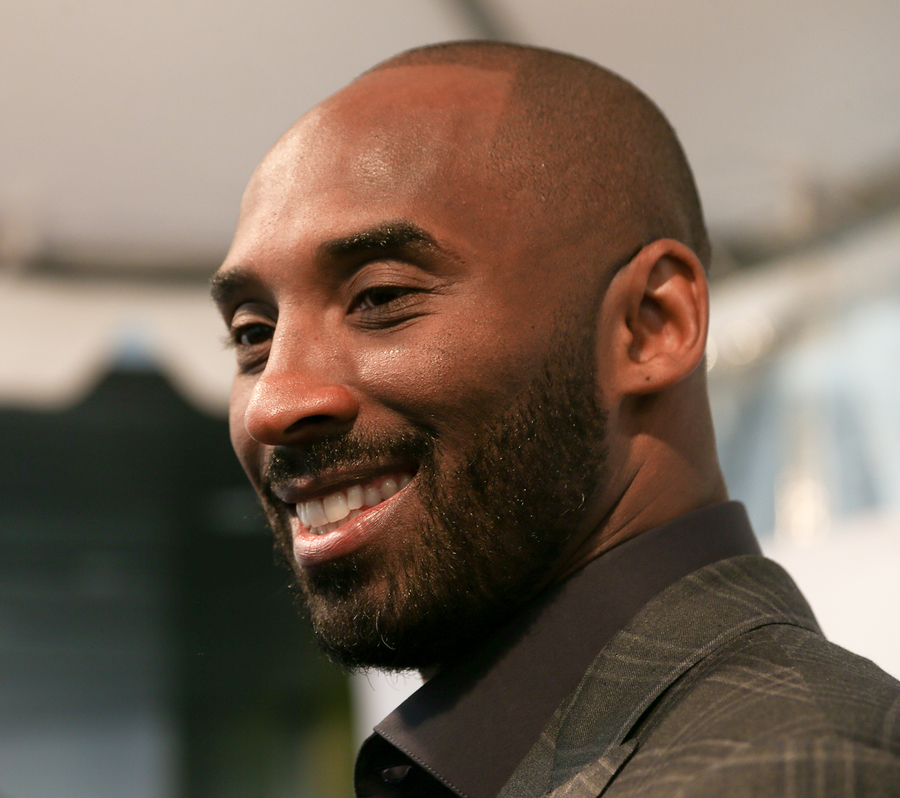

Whenever someone so beloved dies so young, it highlights just how critical it is for every adult, especially those with young children, to create an estate plan to ensure their loved ones are properly protected and provided for when they die or in the event of their incapacity. While the death of Kobe, his daughter, and the others is terribly sad, it motivates you to get your estate planning handled the right way, or updated, the tragedy just might have some positive impact.

Estate Planning · January 24, 2020

Whether you’re in the midst of a divorce, have been divorced for years, or are married with a prenup, it’s critical that you meet with your Personal Family Lawyer® and qualified tax advisor to discuss how this provision of the TCJA stands to affect you. Depending on your situation, you may modify your existing legal agreements to bring them into better alignment with the new rules or, establish a planning tool that could offset or lessen the new law’s impact on your tax obligations.