Business · March 09, 2022

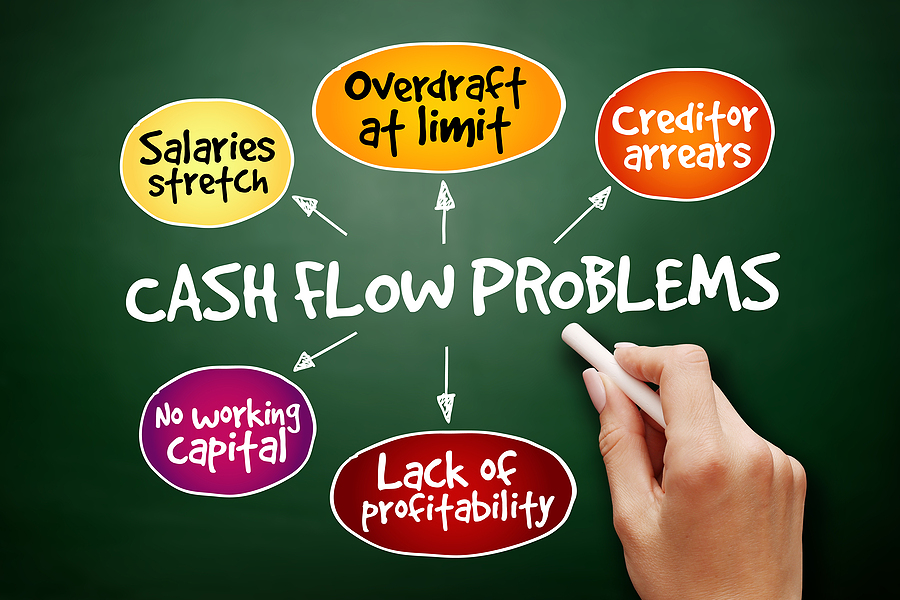

Cash is the lifeblood of any business. Far too many businesses, most owners do not adequately manage their cash flow. Trying to manage a business without properly controlling your cash flow is like fighting a rising tide. Even if your company earns a solid profit, you may have cash flow problems from time to time, especially true during the first few years of operation.

Get savvy about growing your cash flow by applying these five techniques to avoid entering the ranks of insolvent companies.

Business · March 07, 2022

Moving a business to another state involves several decisions and steps. A business owner may relocate a business for various reasons, including increased real estate costs, business taxes, business regulations, changes in the target market, or even personal or family reasons. But relocating your residence from one state to another is much more complicated and difficult to determine what to do first because the steps needed for a successful move vary depending on your business structure.

Business · December 15, 2020

Building your own business takes a lot of courage and considerations because it requires great effort to acquire some level of recognition an already established business may have. Yet if you feel that purchasing a business that is already in existence is the best option instead of starting one from the ground up, then you must critically consider the following before purchasing one.

Business · January 28, 2020

Owning copyright contents is one factor that contributes success to your business and registering your work with the U.S. Copyright Office makes it easier for you to be successful in a lawsuit against an infringer.

Business · December 31, 2019

There are many factors to consider when deciding whether to change the structure of your small business especially if it is growing and expanding. By this, for any type of change, it is important to make sure that you complete all the notifications and registrations required by the state law. If you need help in implementing the business structure that is the most advantageous for your individual circumstances, consult with us so we can guide you step by step with the process.

Business · December 24, 2019

Although the home office deduction was eliminated for employees as part of the 2017 tax reform, owners of home-based businesses may still take advantage of this deduction as long as they meet the following requirements set out by the IRS. Read here to know more. We'll be happy to provide guidance about how to maximize your tax saving and meet your legal obligations if you're uncertain whether your home-based small business is eligible for the home office deduction or have other tax questions.

Business · December 17, 2019

It is critically important to be knowledgeable about the type of risks and legal issues your small business may encounter, especially if you are considering to start expanding your physical business or just starting a home-based business to ensure that your business is compliant with the law and that your interests are protected. With the help of an expert and with your knowledge of the issues you need to consider for your business, you will surely succeed in your new venture.

Business · December 10, 2019

Managing Retirement Assets Investments yourself has its own pros and cons and whether you choose to manage your retirements assets investments on your own or hire a professional financial advisor, it is always important that you have a clear vision for your financial future and that you understand the financial concepts along with the legal rules associated with your kind of investments to ensure it is protected and to avoid hefty fines.

Business · November 26, 2019

As a business owner, it is critically important for you to maintain a summary of your business transactions and retain all important documents that can be used to verify the accuracy of your summary for tax purposes. Keeping good records of your transactions and tax invoices will help you to monitor the financial performance of your business as well as comply with your tax obligations.

Learn here the documents your small business should keep.

Business · November 19, 2019

If you are interested in starting a new business, it is critically important to know not just all the requirements, federal, and state laws of Business Opportunities but also, to know the seller whom you are dealing with to ensure that you are not misled and that it is legitimate. Contact an experienced business lawyer like us so we can guide you through the purchase of a business opportunity, a franchise, or a pre-existing business.