Estate Planning · March 01, 2024

It's easy to prioritize other business matters over estate planning when you're running a business. But, in reality, one of your most pressing responsibilities is to consider what would happen to your business if you became incapacitated or died. Although estate planning and business planning may be two distinct tasks, they're inevitably linked. And, because your company is likely your family's most valuable asset, estate planning is critical not only for your company, but also for your family.

Estate Planning · September 03, 2021

Giving donations to a charitable cause is a noble act of kindness. And you are also likely well aware that as with donating to charity during your lifetime, dedicating a portion of your estate to a charitable cause can reduce the taxable value of your estate. But it doesn’t end here. You may be surprised to learn about the numerous benefits available when you incorporate charitable giving into your estate plan. Learn more here!

Estate Planning · August 27, 2021

Wills and trusts are two of the most commonly used estate planning documents. Both documents are legal vehicles designed to distribute your assets to your loved ones upon your death, but the way in which they work is quite different. To know the best way to determine whether or not your estate plan should include a will, living trust, or some combination of the two, meet a Personal Family Lawyer for a Family Wealth Planning Session.

Estate Planning · August 20, 2021

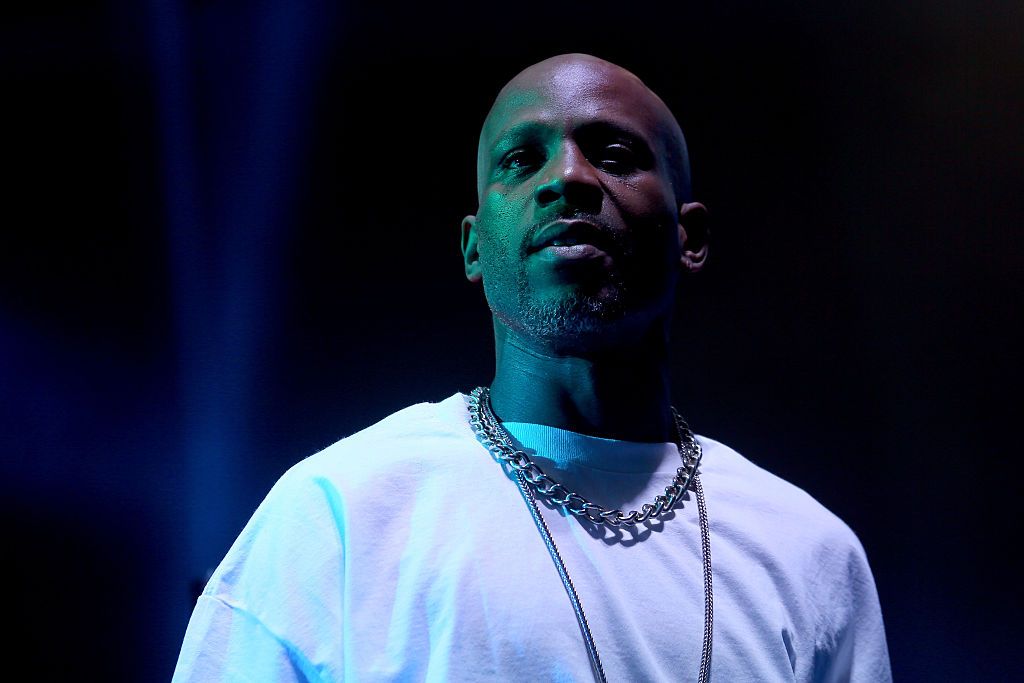

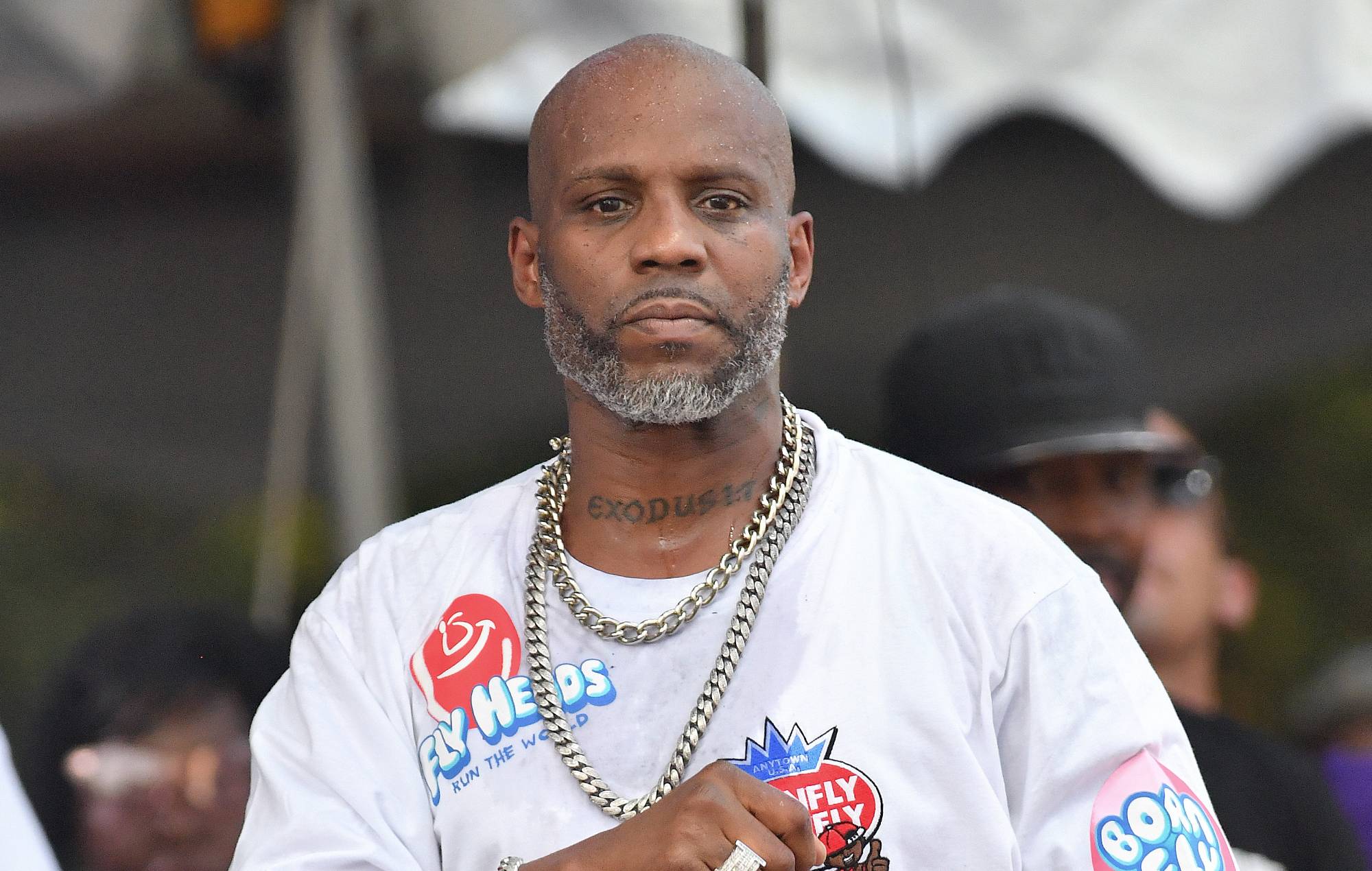

Although DMX was successful in music and movies, the rap icon experienced serious legal and financial problems. His story proves that regardless of your financial status, planning for your potential incapacity and eventual death is something you should take care of, especially if you have children. The saddest part of this whole situation is that all the conflict, expense, and trauma that DMX’s loved ones are likely to endure could have been prevented with comprehensive estate planning.

Estate Planning · August 13, 2021

Legendary hip hop artist Earl Simmons, known as DMX, passed away at age 50 after suffering a heart attack. Despite selling more than 74 million albums and enjoying a wildly successful career in music and movies, DMX, who died without a will, left behind an estate that some estimates report being millions of dollars in debt. With so much wealth and so many children, his failure to create an estate plan will likely mean his loved ones will be stuck battling each other in court for years to come.

Estate Planning · April 30, 2021

Nearly three years have passed since Aretha Franklin, known as the “Queen of Soul,” whose earnings are worth $80 million, died from pancreatic cancer at age 76. Yet, due to poor estate planning, her children have yet to see a dime of their inheritance, and what they ultimately receive will be significantly depleted by back taxes. Also, it’s still not clear whether or not Aretha ever had a valid will. Her story shows how destructive poor estate planning can be for the loved ones we leave behind.

Estate Planning · February 26, 2021

Every state has different terms for what happens when you become incapacitated or die, especially when you have a blended family. One of the most common problems that arises of having a blended family is that the deceased’s children from a prior marriage and the surviving spouse end up in conflict. Unless a comprehensive plan has been created. That way, not only do the people you love get the assets that you want them to receive, but you may also be saving them for years of legal conflict.

Estate Planning · February 19, 2021

With everything that is happening in the world—and with the volatility of the stock market and our current reality —knowing your options is vital to preserving the life and legacy of your parents. If you or your parents have a retirement account, and you're not intimately connected to how your assets are being invested, it's time to get more involved. It's the best thing to do to preserve your family's legacy.

Estate Planning · January 26, 2021

Setting up a trust is a great way of securing your assets, reduce tax obligations, and define the management of your estate according to your wishes, even if you're wealthy or not. It's the best decision to set up a trust while you still can since it has different types, and each has various tax consequences. Choose what's best for your family so that when the time comes that you're incapacitated, their future will be safe. Learn more to help you weigh decisions and make the right choice.

Estate Planning · January 15, 2021

A comprehensive and detailed estate plan would be meaningless if it cannot be accessed quickly during emergencies. That is why, it is convenient to have a go-bag to place in your estate documents and other essentials. This is especially true with the current pandemic filling hospitals to the brim. Unexpected events can occur anytime—you or a loved one could get hospitalized alone. Without immediate access to the plan, important medical decisions might be delayed to your family's detriment.