Estate Planning · August 15, 2025

Inheriting a home comes with more than memories. From security risks and maintenance issues to insurance complications, managing an inherited property can quickly become overwhelming. Without planning, families may face unexpected costs and conflicts during an already difficult time. This article shows what to expect and how proactive Life & Legacy Planning® helps protect both the property and your loved ones. Read more.

Estate Planning · August 08, 2025

A $17B fortune. Over 100 heirs. One bold estate plan. Telegram founder Pavel Durov’s story reveals why even the most “equal” inheritance can unravel without legal clarity. Whether your family is large or small, the right plan prevents conflict, protects your values, and keeps your wishes intact. Read more to see how thoughtful planning works in the real world.

Estate Planning · August 01, 2025

As parents and grandparents, we all want to secure a bright future for our children. Giving them the best education is the dream, but rising tuition costs can make it feel out of reach. With numerous funding options, families often feel unprepared, which can risk compromising their child’s educational goals. The key isn’t just saving, but creating a smart, informed strategy that protects dreams and makes higher education attainable. Read more.

Estate Planning · March 31, 2025

Navigating the end of a relationship, whether through breakup, divorce, or death, is a reality we often shy away from. Yet, it's essential to plan for these eventualities to protect ourselves, our partners, and our assets. The intersection of love and law is complex, involving critical areas such as property ownership, healthcare decisions, guardianship for children, and business interests. Without proper planning, you risk leaving your loved ones vulnerable to legal and financial difficulties.

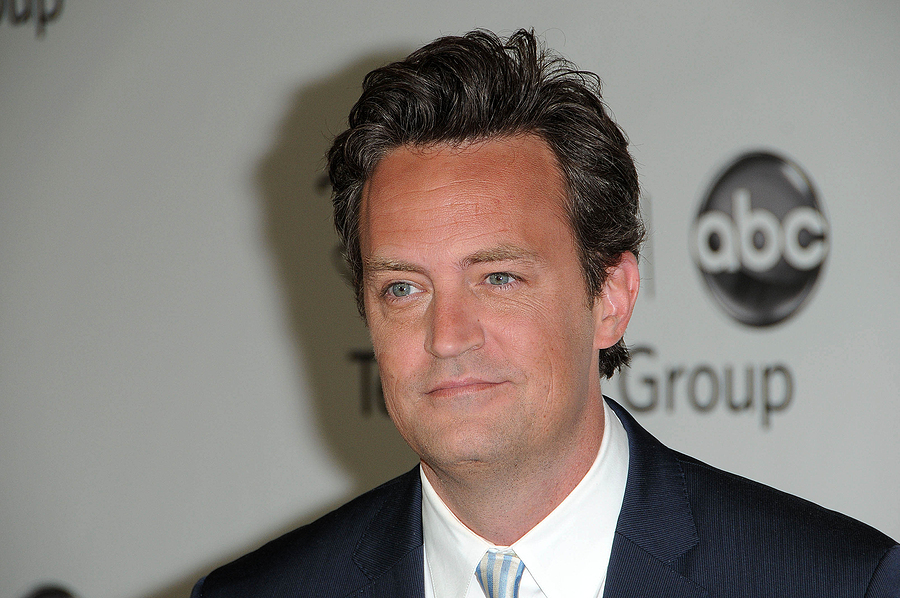

Estate Planning · September 16, 2024

When Matthew Perry passed away, the iconic actor left behind a curious financial puzzle—despite earning millions, only a fraction of his wealth was immediately apparent. This serves as a pivotal lesson on the power of advanced estate planning, specifically the strategic use of trusts. Delve into the complexities of Perry's estate strategy and uncover how properly structured trusts not only preserve wealth but also maintain privacy, avoid costly probate, and ensure your legacy is managed accordin

Estate Planning · August 23, 2024

Imagine discovering thousands of dollars that belong to you, only to be told you can't have it. It’s called “unclaimed property,” which is money that’s yours but has been handed over to the government without your knowledge. And it happens more often than you may think. Read more…

Estate Planning · August 16, 2024

Imagine this: You're in your twenties and you fill out a form at work, naming your significant other as the beneficiary of your retirement account. Fast forward 28 years - you've long since broken up, lived a full life, and died, and your ex gets your now-million-dollar nest egg. Sound far-fetched? It's not. Read more…

Estate Planning · July 26, 2024

As we wrap up our celebrity estate series, we turn our attention to an icon whose estate still resonates beyond his lifetime: Elvis Presley. This final installment explores how even a legend like Elvis isn't immune to the threats posed by scammers—a lesson for us all. His Graceland estate recently faced a fraudulent claim that put his assets at risk, shedding light on the vital need for vigilant asset protection. Learn the signs of potential scams and the proactive steps you can take to protect

Estate Planning · July 19, 2024

Celebrity lives often seem distant from our own, yet when it comes to preparing for the inevitable, such as incapacity, their stories can offer valuable lessons. This week, we delve into Jay Leno's personal experience, illustrating the complexities of incapacity planning that many overlook. Incapacity isn't just a remote possibility; it's a critical aspect of estate planning that can significantly impact your loved ones if not addressed properly. From understanding the legal implications to reco

Estate Planning · July 12, 2024

Celebrity estate plans can be as headline-grabbing as their careers, and this week, we’re diving into how stars like Vanilla Ice manage their legacies. Vanilla Ice reveals his approach to estate planning, shedding light on the often overlooked importance of proactive financial management. From utilizing trusts to smart tax strategies and the vital role of life insurance, his insights offer valuable lessons for anyone. His experiences underscore the necessity of having a well-thought-out plan to